Global Standards for Sustainability and Climate Disclosures

IFRS Foundation (International Financial Reporting Standards)

Develops and oversees global

standards

ISSB (International Sustainability Standards Board)

Develops IFRS Accounting

Standards, adopted by over 140

jurisdictions.

IASB (International Accounting Standards Board)

Develops IFRS Sustainability

Disclosure Standards to ensure

consistent sustainability reporting.

MATERIALITY IN IFRS

Definition of Materiality

Under IFRS S1, information is material if its omission or

misstatement could influence investor decisions.

Materiality applies to both financial and sustainability

disclosures to ensure users get decision-useful

insights.

How IFRS S1 & S2 Approach Materiality

- Entity-Specific: Materiality depends on a company’s business model, industry, and financial impact.

- Investor-Centric: Emphasizes financial materiality aligned with investor needs.

- Integrated Reporting: Sustainability risks disclosed alongside financials for a complete view of enterprise value.

OVERVIEW OF IFRS S1 & S2

IFRS S1 (General Sustainability)

- Defines how companies must disclose sustainability-related financial information.

- Focuses on how sustainability risks/opportunities impact future prospects, ensuring transparency and comparability.

IFRS S2 (Climate-specific)

- Focuses on climate-related risks and opportunities.

- Requires disclosures on governance, strategy, risk, and metrics—aligned with TCFD recommendations.

IFRS S1 & S2

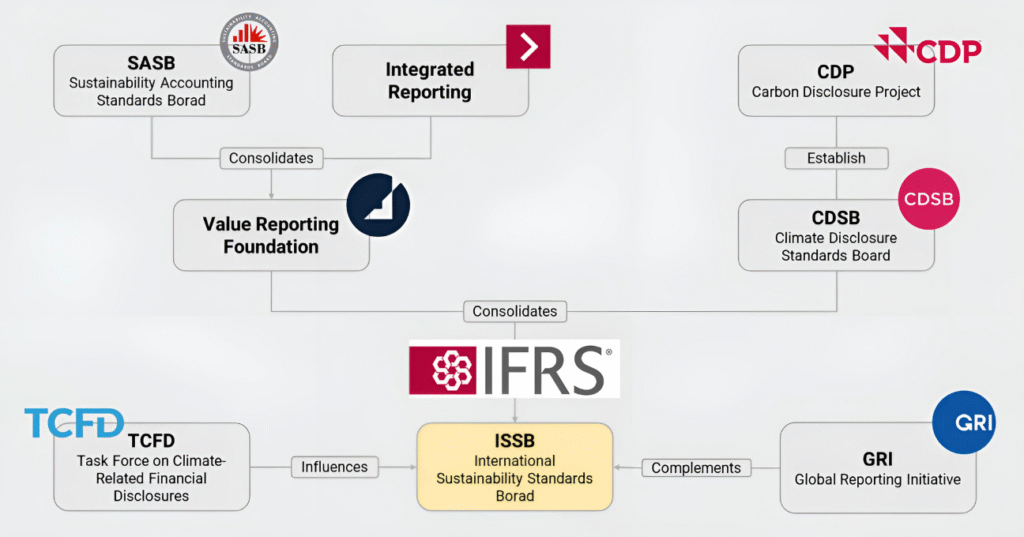

The Evolution of IFRS S1 & S2

CONSOLIDATION OF SUSTAINABILITY REPORTING STANDARDS

ISSB builds on TCFD and consolidates global

standards like SASB, IR, and CDSB, while working

with GRI to ensure interoperability.

KEY DISCLOSURE AREAS Ask ChatGPT

| For IFRS S1 (General Sustainability) |

For IFRS S2 (Climate-specific) |

|---|---|

| Board & management oversight of sustainability risks | Board & management oversight of climate risks |

| Sustainability risks, opportunities & financial impact | Climate risks, opportunities & financial impact |

| Identifying & managing sustainability risks | Identifying & managing climate risks |

| Sustainability performance indicators | Climate performance indicators |

REPORTING TIMELINES

EFFECTIVE DATE

IFRS S2 applicable for annual reporting periods beginning Jan 1, 2024

ADOPTION TIMELINE

Gradual uptake expected globally, influenced by local regulators

CORE REQUIREMENTS FOR IFRS S1

| Governance |

|

|---|---|

| Strategy |

|

| Risk Management |

|

| Metrics & Targets |

|

CORE REQUIREMENTS FOR IFRS S2

| Governance |

|

|---|---|

| Strategy |

|

| Risk Management |

|

| Metrics & Targets |

|

Follow us

for regulatory updates

and expert insights on

ESG, EPR (India & UK), and

sustainability compliance.